Investing in a portfolio is a great way to grow your wealth over time. By diversifying your investments across different asset classes, you can reduce risk and potentially increase your returns. However, managing a portfolio can be complex and time-consuming. To maximize your wealth with a portfolio, it’s important to have a solid strategy in place. Here are five tips to help you make the most of your investments.

1. Diversify Your Investments

One of the key principles of investing is diversification. By spreading your investments across different asset classes, such as stocks, bonds, real estate, and commodities, you can reduce the risk of losing money if one sector performs poorly. Diversification can also help you capture the returns of different asset classes, potentially increasing your overall returns. To effectively diversify your portfolio, consider using asset tracking software to monitor your investments and ensure you have a well-balanced mix of assets.

2. Rebalance Your Portfolio Regularly

Over time, the value of your investments may shift, causing your portfolio to become unbalanced. To maintain an optimal asset allocation, it’s important to rebalance your portfolio regularly. This involves selling assets that have performed well and buying assets that have underperformed to bring your portfolio back in line with your target allocation. Asset tracking software can help you track the performance of your investments and identify when it’s time to rebalance your portfolio.

3. Monitor Your Investments Closely

To maximize your wealth with a portfolio, it’s important to stay informed about the performance of your investments. Regularly monitor the value of your assets, track your investment returns, and keep an eye on market trends that may impact your portfolio. Asset tracking software can help you stay organized and up-to-date on your investments, making it easier to make informed decisions about your portfolio.

4. Consider Tax Efficiency

Taxes can eat into your investment returns, so it’s important to consider tax efficiency when managing your portfolio. Look for tax-efficient investment strategies, such as holding investments in tax-advantaged accounts like IRAs or 401(k)s, and consider tax-loss harvesting to offset gains with losses. Asset tracking software can help you keep track of your tax liabilities and optimize your portfolio for tax efficiency.

5. Seek Professional Advice

Managing a portfolio can be complex, especially as your wealth grows. Consider seeking advice from a financial advisor or investment professional to help you develop a solid investment strategy and make informed decisions about your portfolio. An advisor can help you navigate the complexities of investing, provide personalized recommendations based on your financial goals, and help you maximize your wealth over time. With the help of asset tracking software, you can work with your advisor to monitor your investments and make adjustments as needed to achieve your financial objectives.

In conclusion, maximizing your wealth with a portfolio requires careful planning, diversification, and regular monitoring of your investments. By following these tips and using asset tracking software to manage your portfolio, you can make the most of your investments and achieve your financial goals.

For more information visit:

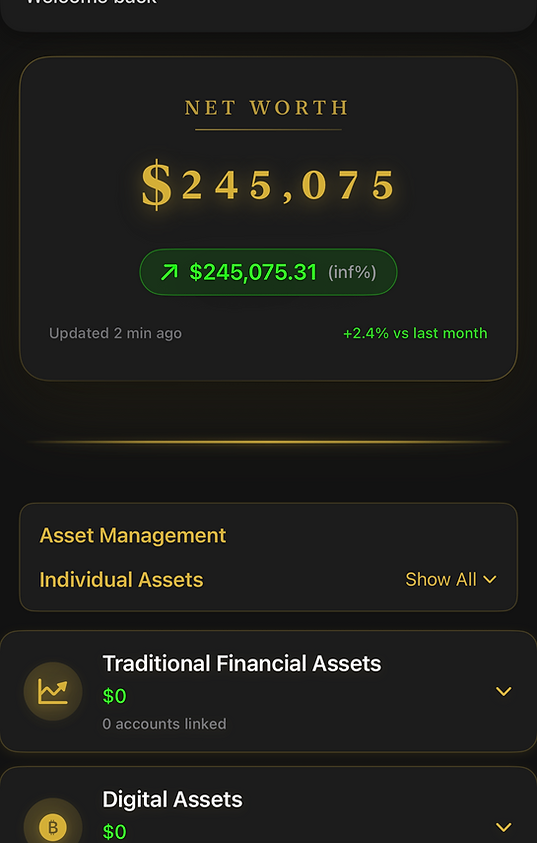

Portfolio | Finance Tracking App

https://www.portfoliogrow.com/

La Mesa – California, United States

Portfolio is a sleek finance tracking app that helps you monitor net worth, manage investments, and grow wealth with ease. Track assets, liabilities, and performance in one place to stay in control of your financial future.